ARCHIVED FINANCIAL INFORMATION

15 Years of Tough Decisions

West Clermont has made cuts at the classroom level, which impact the student experience, as well as reductions to district-wide services. We operate with a cost per pupil that is 24% lower than the state average, which means our students have opportunity gaps in programs and services. In fact, we are unable to provide the level of academic and support services we used to provide prior to 2011. A look ahead at our five-year forecast, which projects minimal growth in state funding and local property taxes, continues to show that the current level of services and programs is not sustainable.

Positive Momentum

Despite a challenging financial landscape, there is positive momentum in our district with renewed pride, unity, progress in academic achievement, increased student enrollment and strong partnerships. West Clermont strives to provide a safe, united, and academically challenging environment where all students can define their own success through big dreams, authentic learning experiences, and a caring community.

Collective Commitment

We are currently engaging with students, parents, staff and community members through focus groups, surveys and planning workgroups to design a bold strategic plan that answers the question: What kind of school district does our community want us to be? This blueprint will align to our current financial reality with the flexibility to grow with additional resources. Your feedback will help us determine our community’s educational priorities and determine whether our services will be expanded, remain status quo, or if cuts will be made. To send us feedback, click here.

To follow the development of our Strategic Planning Process.

| Financial Health Family & Community Conversations (Fall 2019) | ||

|---|---|---|

| West Clermont Middle School (9/4/19) | Clough Pike Elementary School (9/5/19) | Amelia and Holly Hill Elementary Schools (9/10/19) |

| Merwin Elementary School (9/10/19) | Willowville Elementary School (9/11/19) | Summerside Elementary School (10/1/19) |

| Withamsville-Tobasco Elementary School (10/10/19) | West Clermont High School (10/16/19) Link to YouTube Live Presentation: https://youtu.be/ZQZ0Uz6Swss |

|

-

Financial Health (Spring 2019)

-

Partners in Education

-

March 2020 Ballot Issue

-

Community Survey (Fall 2019)

Printer-Friendly version of the Levy for Learning Summary Snapshot (Updated 2-7-20).

Community Postcard (Digital Version)

FREQUENTLY ASKED QUESTIONS

(Updated 4-3-20)

Click here for a printer-friendly version of the Frequently Asked Questions

Can I still vote in Ohio's March Presidential Primary?

On March 25, 2020, the Ohio General Assembly passed House Bill 197, a sweeping piece of legislation aimed at dealing with the state’s response to the Coronavirus/COVID-19 pandemic. Among other items, the bill sets April 28, 2020 as the final day of Ohio’s primary election.

How do I request a vote-by-mail absentee ballot?

Click here for instructions on how to request an absentee ballot.

Where can I get more information about voting in Ohio?

For voting information, visit voteohio.gov

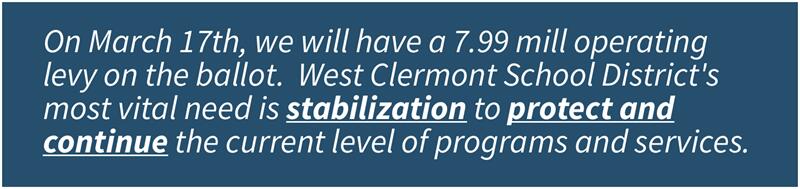

What is on the March 17, 2020 ballot for West Clermont?

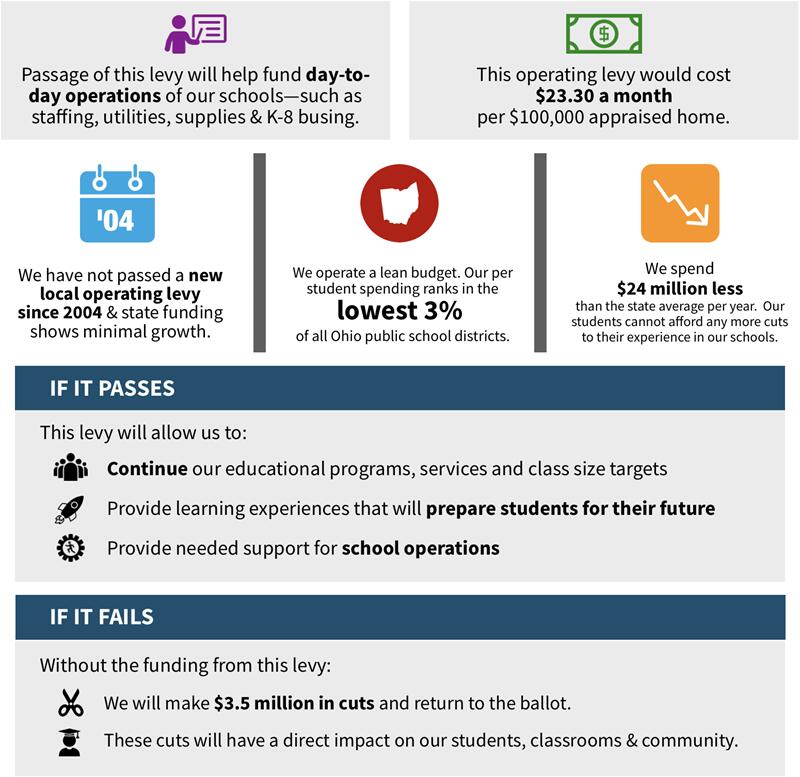

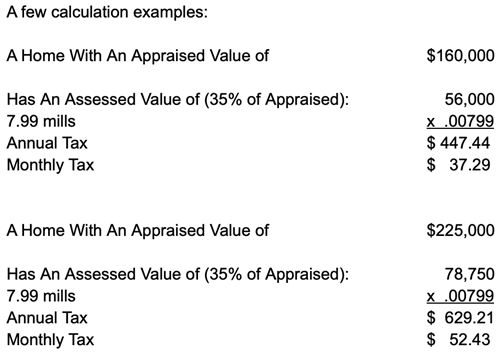

A 7.99-mill emergency operating levy that will be collected annually for 10 years for day-to-day operations of the district.

What would the levy cost me?

The operating levy will cost taxpayers $23.30 per month per $100,000 appraised home.

To see how the levy will impact you:

1. Log on to the Clermont County Auditor's website and search for your property

2. On the left side of the screen, click on the light blue button that says:

What happens if the levy passes?

West Clermont is on the rise and committed to excellence with every learner, every day, in every way. We know that strong schools create strong communities and it takes a collective commitment from all of us to move this District forward.

The board, administration and staff are committed to improving the student experience at West Clermont. We are seeing improvements in academic performance and more families are choosing West Clermont because they value what we do. Building on this positive momentum is key to our future success. Stabilizing our foundation of programs, services, teachers and staff is crucial if we are to continue to be creative, innovative and equip our students for success.

The passage of this levy will bring that stabilization and provide future opportunities to build capacity and advance educational experiences for each learner. We will work hard to make the levy last as long as possible and with your help, will continue to seek strong partnerships and innovative solutions to meet our students’ needs. Depending on the economy, state funding and the community’s desire for more services, there may be a need for additional support prior to the end of the ten year collection period.

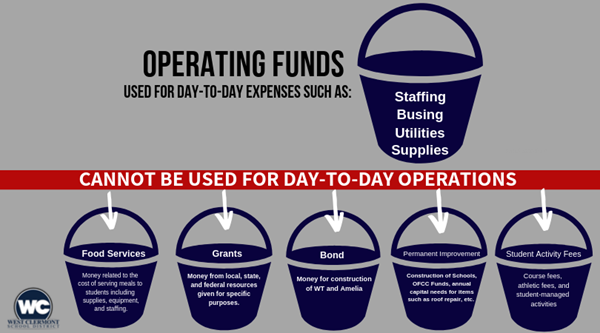

What will the levy fund?

The levy will help fund the day-to-day operations of our schools, such as staffing, utilities, supplies and K-8 busing. This levy will allow the district to stabilize the current level of student programs and services. For more information on the operational budget, please see the District’s most recent five-year forecast.

Why now?

The discussion to submit a ballot issue to the voters in 2020 has been part of board discussions for two years. Discussions began with the former superintendent and treasurer, who retired in July and October 2018, respectively. During the interview process for the new superintendent and treasurer, the topic of a ballot issue was given significant emphasis. With both the new superintendent and treasurer in place by November 2018, the board and administration prioritized three interrelated financial areas of focus:

- Updating the five-year forecast

- Family & community engagement (strategic plan & financial health)

- Preparing for a 2020 ballot issue

In order to place an issue on the March 2020 ballot, state law required that the Board of Education take action on two separate resolutions and file all necessary documents by December 2019. The District filed the necessary documents on November 25th.

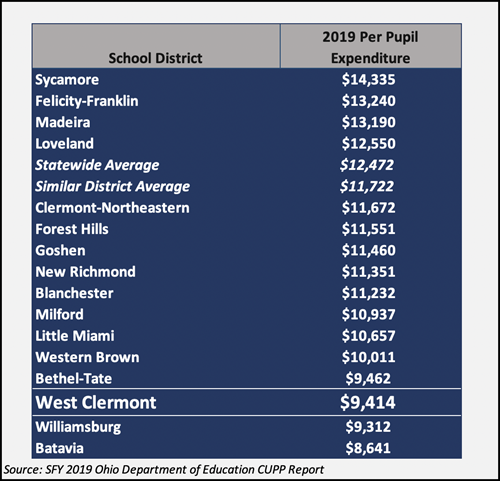

Our five-year forecast, which projects minimal growth in state funding and local property taxes, continues to show that the current level of services and programs is not sustainable. Based on the Ohio Department of Education's 2019 Cupp Report (released December 2019), we are one of the lowest spending districts in the state; our per pupil spending ranks in the lowest 3% of Ohio public school districts. Our students and staff have lacked adequate operational funding and resources for years and, as a result, we are falling behind; this reality can be attributed to the broken state funding model for public schools and a local tax effort that is less than the statewide average.

If this passes, will this be an addition to my tax bill or does this take the place of a previous voted tax issue?

This will be a new tax. All existing operating millage that appears on a resident’s tax bill has been approved by our voters as continuing. Residents did see .61 mills from a 1994 bond issue roll off their tax bill in tax year 2017 (payment year 2018). If the levy passes, property tax collection will not begin until January of 2021.

What happens if the levy fails?

Unfortunately, the district’s operational needs will not go away with failure at the ballot, and the district will have to cut $3.5 million of student services and programs at the beginning of the 2020-21 school year and return to the ballot. In West Clermont, $3.5 million is equivalent to 60 staff positions. The failure of this levy would jeopardize our ability to provide students with the current level of programs and services would jeopardize our ability to retain staff. As this district has seen in the past, levy failures have resulted in significant cuts to student programs, experiences and opportunities. The Board of Education approved $3.5 million of cuts at its January 13th Board meeting. The list of approved cuts can be found below in the section titled “$3.5 MILLION OF REDUCTIONS.”

What happens if the district continues without this additional funding?

Our district can only fund what we can afford. The fiscal reality we face is that cuts will be needed if we do not receive additional revenue. Our community has been through this before and knows that cuts hurt and there are lasting consequences when reductions are made to student programs and services. Based on our history, we know we risk lower academic performance and growth, lack of much needed resources and loss of students, families and staff to neighboring districts which may lead to decreased property values, as well as, the quality of education. Without additional revenue, we will not be able to provide the current services and programming.

When was the last operating levy passed by the district?

The last emergency operating levy passed by West Clermont voters was 15 years ago in 2004 for 7.9 mills (renewed as a substitute levy in 2009 for a continuing period of time with no expiration).

Why is the district not on the ballot for more than 7.99 mills to help restore some services and programs?

The request for 7.99 mills addresses our most vital need, which is stabilization to protect and maintain the programs and services we currently offer to our students. Community input over the last several months indicates that a majority of our community supports the need for additional local funding and does not want to see cuts; however, there are mixed results with the amount the community is willing to pay.

In addition, results of our community survey show different priorities for adding beyond the 7.99 mill levy. The top priorities were 25.7% restoring high school busing and 24.2% reinstating or expanding programs like art, music and physical education (specials). Since there isn’t a clear top priority, adding either buses or specials could negatively affect the outcome of meeting our most vital need – stabilization.

A MORE IN DEPTH LOOK AT FINANCES

How is the district financially accountable?

Budgets are a statement of an organization’s priorities and how an organization allocates and manages its finances is a testament to that. Under the leadership of the district superintendent, treasurer and board, it is clear that West Clermont is intent on stretching dollars and resources, and operating a lean, daily operational budget.

West Clermont has repeatedly received the Certificate of Achievement in Financial Reporting from the Government Finance Officers Association, as well as, the Certificate of Excellence in Financial Reporting from the Association of School Business Officials.

Where does West Clermont get its funding for day-to-day operations?

West Clermont Schools receives 48% of its operating revenue through local taxes, 42% through state funding, 6% from homestead and rollback exemption, and 4% from other sources such as tax increment financing payments and interest income. Of the local property tax revenue, 70% is generated through residential property taxes. West Clermont Schools depends on the local community for support to provide educational services to our students. The district has done as much as it can without passing a new operating levy for 15 years.

How does West Clermont spending compare to other districts?

According to the 2019 Cupp Report published by the Ohio Department of Education, our per pupil spending ranks in the lowest 3% of all Ohio public school districts. It costs the average school in Ohio $12,472 to educate a student each year and West Clermont only spends $9,414.

Isn’t it a good thing that West Clermont spends less per student than most districts in Ohio?

While we are doing as much as we can with less, it’s clear that our students are often going without services that are considered standard in other districts. The district’s low spending is reflective of the reduction of programs and services provided to students over the last 15 years.

How did West Clermont build new schools if the district is lacking financial resources for day-to-day operating?

The most recent construction projects of Summerside, Willowville and Clough Pike elementary schools were made possible through our partnership with the Ohio Facilities Construction Commission (OFCC). The OFCC provided $45 million of state funds for these projects, as a result of the district’s previous local investment in its facilities.

For West Clermont, the OFCC required a 70% local investment ($106 million) in order for the OFCC to provide the 30% state investment ($45 million). West Clermont met its $106 million local investment through the construction of Amelia Elementary and Withamsville-Tobasco Elementary schools, as well as, the new high school.

The construction of Amelia and Withamsville-Tobasco elementary schools was made possible through a bond issue that was approved by West Clermont voters in 2007 specifically for the construction of these buildings. The annual bond payment is financed with property tax collections.

Without increasing our community’s taxes, the construction of the high school was made possible by the issuance of lease revenue bonds by the Clermont County Port Authority, on behalf of the district. The financing plan to fund the annual lease payment includes a combination of tax increment financing (TIF) revenue to be received when the Union Township Glen Este property is developed, as well as, the district’s existing inside millage. Currently, the annual lease payment is financed entirely with the district’s inside millage.

NOTE: Every public school district in Clermont County receives inside millage. West Clermont has dedicated, by resolution, its entire 4.2 mills to permanent improvement and cannot use these revenues for day-to-day operations. There is no additional inside millage to move.

These 21st century facilities provide our students with a safe, clean and modern learning environment. Without these improvements and upgrades, the district would face significant facility needs in addition to our current operating needs.

I've heard the District has vacant undeveloped property. Why not sell it to generate revenue to cover expenses?

The District does not own any vacant undeveloped property.

Has the District experienced an increase in utility costs since building the new schools?

The District's utility costs (electricity, gas, water & sewage) have remained relatively consistent over the last decade. Utility costs for fiscal year 2009 were $1,355,543, while utility costs in fiscal year 2019 were $1,423,157. From 2010 to 2019, the District increased its square footage and added air conditioning to several buildings.

With all the new construction and new homes, isn't the District getting a lot more property tax money to help with operating expenses?

The appraised Class I & Class II property valuations in West Clermont increased $487,000,000 from tax year 2016 to 2018. Due to the impact of House Bill 920, the District received approximately $370,000 more in property tax revenue per year, which is less than 3 days of operating salaries.

$3.5 MILLION OF REDUCTIONS

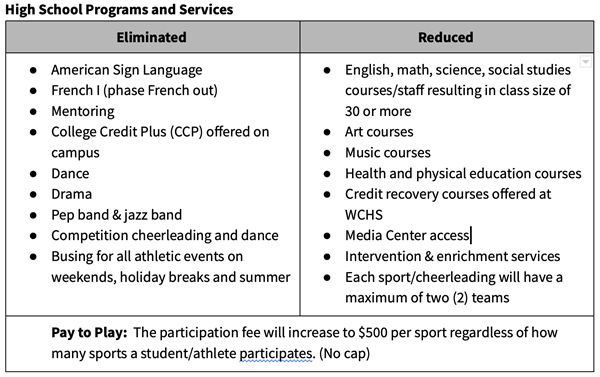

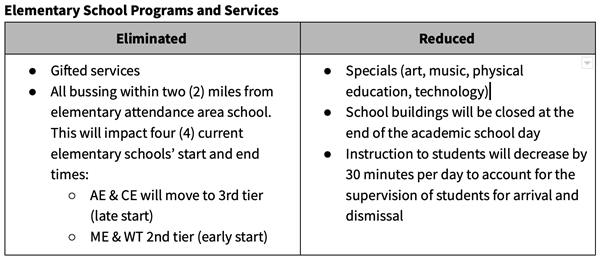

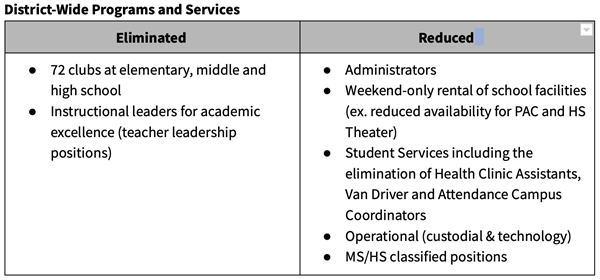

What will be included in the $3.5 million of reductions that take effect at the beginning of the 2020-2021 school year?

Can you clarify what “72 Clubs Eliminated” means?

The paid positions for the following 72 clubs will be eliminated:

If the March levy does not pass, one of the board-approved reduction is to reduce transportation to the minimum two-mile state requirement for elementary and middle school students. How is the two-mile walking area calculated?

The distance is calculated from the end of the resident's driveway to the entrance of the child's school using the most direct route by motor vehicle, excluding interstate routes.

Daycare or private/parochial/community school transportation is calculated with the same process - students who live within a two-mile driving distance of the school of attendance will not receive transportation provided by the school district.

EXPLAINING BALLOT ISSUES IN OHIO

Our district has grown and property values have increased, so why doesn’t the school have adequate funding?

The state has a law - House Bill 920 - that keeps local school funding flat, regardless of a community’s growth. This means that even as property values go up, the total amount collected by a school district on the emergency levy stays the same. For example, the last operating levy passed by West Clermont voters was in 2004 for 7.9 mills. In 2020, taxpayers only pay 6.69 mills on that levy. Ohio’s law has reduced the tax rate from 7.9 mills to 6.69 mills, based on the increase of property values, so the amount the school gets stays the same.

House Bill 920 is why public school districts must return to the ballot every few years to ask taxpayers for support. West Clermont Schools has not received an increase of local operating voted millage since 2004. Click here to watch a short video that explains more about the law.

What is the difference between an operating tax levy and bond issue?

In West Clermont there are two ways the community partners with the school district for funding.

Operating Tax Levy: A property tax used for day-to-day operational needs. The last operating tax levy passed in West Clermont was in 2004 for a collection period of five years. It was renewed as a substitute levy in 2009 to be collected for a continuing period of time with no expiration.

Bond Issue: A property tax levy used to provide money for construction purposes. The proceeds of this levy are not permitted to be used for day-to-day operating needs. The last bond issue passed in West Clermont was 2007 for the construction of Amelia and Withamsville-Tobasco elementary schools.

Operating Levies are for Learning while Bonds are for Buildings. You may find this graphic helpful:

Why an “emergency” levy?

“Emergency” is only a label that is in the state statutes; many districts routinely pass this type of levy. This type of levy generates a specific dollar amount in revenue and the levy is adjusted each year to not generate more or less than the ballot amount. This is the same type of levy West Clermont voters supported in 2004.

Does “mill” mean millions? What is a “mill?”

A “mill” does not mean millions. A mill is the unit of value for expressing the rate of property taxes in Ohio. It is defined as 1/10 of a percent or 1/10 of a cent (0.1 cent). “Millage” is the factor applied to the assessed value of property to produce tax revenue.

What’s the difference between the appraised value and the assessed value of a home?

For tax purposes, a home is taxed on its assessed value, not its appraised value. The assessed value is 35% of the appraised value as determined by the county auditor. For example, a home that is appraised at $100,000 by the auditor is taxed only on $35,000.

The County Auditor's Office has added a "Proposed Levies" section on your online property profile located at: www.clermontauditor.org. This will tell you how this levy will affect you specifically, on an annual basis.

VOTING INFORMATION

When is Election Day?

Voting in the March 17 election has been extended to Tuesday, April 28.

How do I register to vote for this election?

The deadline to register for this election was February 18.

How do I vote in this election?

To request to vote by mail with an absentee ballot, call the Clermont County Board of Elections at (513) 732-7275 or visit http://www.ohiosos.gov/elections/voters/absentee-ballot/

Remember to allow time for the vote by mail process.

What are the important dates/deadlines for the vote-by-mail process?

According to the Clermont County Board of Elections website, these are the important dates for voters:

April 27, 2020

Absentee ballots must be postmarked by this date

April 28, 2020 - 7:30 pm

Deadline to drop off voted ballots to the Board of Elections office

Will there be in-person voting on April 28th?

According to the Ohio Secretary of State website, yes, there will be in-person voting on April 28th. However, since most Ohioans are being advised to stay home right now, the new law only allows for limited in-person voting on April 28th. In-person voting will only occur on April 28 and only at boards of elections early vote centers, not at precinct polling locations. And in-person voting will only be available for individuals with disabilities who require in-person voting and those who do not have a home mailing address. For more information, visit https://boe.clermontcountyohio.gov.

This site provides information using PDF, visit this link to download the Adobe Acrobat Reader DC software.